Power & Passion – Sexually Transmitted Debt

Power & Passion – Sexually Transmitted Debt

How to avoid, protect and prenup your future financial health

By Jodie Nolan

Economist, Financial Adviser & founder of RICHMum Program

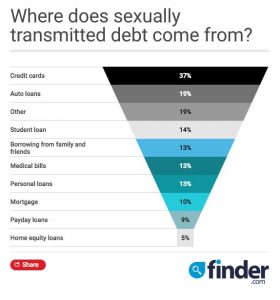

It’s a funny headline but the sad truth is that Sexually Transmitted Debt (STD) is now a real, ‘legislated’ issue in separation, divorce and other financial matters.

Essentially the term coined is used to describe one person being stuck or responsible for their partner’s debt and often leaves them taking on more risk than they knew about. The STD is a nasty financial bug that you can pick up from your romantic partner.

People couple up for many reasons, but don’t always discover if they are a ‘money match’ until well down the track in the relationship. There are generally 3 questions you need to ask as early as possible with your partner;

- Do you have any debts and what are they?

People who incur Sexually Transmitted Debt are those whose money becomes tighter down the track and you then need to help them with the repayments. Keep in mind that their debt could reduce your collective capacity to borrow too.

- What is their credit score?

If you are planning a future together, it is important to know if they have a clean financial and borrowing record, or if this is something they need to work on. A finder.com.au study shows that nearly 1 in 3 Aussie’s are worried about their partners ability to borrow.

- Can they save, stop spending or plan for an important goal?

If your ambition is to own your own home or save for an overseas holiday, can they match you as an equal towards those goals?

Sometimes couples will actively ‘hide’ debt, worried how the other person might react with the hope that they can secretly pay it off over time. Not all couples are transparent in relation to their financial affairs, so it is important to appreciate the boundaries of your relationship – do you share ALL money matter or NO money matters?

Many women can face poverty in their later years if their partner racks up huge debts or refuses access to money. Many partners have no clue what their partner spends money on (alcohol, gambling, shopping etc) and if one person is more dominant and controlling in the relationship, financial inequality will occur. This is highly damaging, may be a sign of abuse and if separation occurs, may mean the difference between living a comfortable financial life or not.

Shockingly, according to an Australian study from 2018, 85% of women don’t fully understand their own finances! In addition, do you know that on average women retire with half the superannuation balance of men!

Common examples of STD’s:

- Joint credit card spending;

- Misuse of funds;

- Unpaid bills, rental agreements, car loans;

- Unauthorised mortgage drawdowns;

- Taking out a loan on behalf of a partner.

How to protect yourself and your financial future:

- Don’t sign anything without knowing what you are signing;

- Keep separate accounts – seriously, at least one separate savings account that you contribute to regularly to build a balance/nest egg/emergency fund and one credit card with $0 balance for emergencies;

- Totally understand any joint debts;

- Talking about financial matters in a relationship is not just important, it is crucial!

Ask yourself, what if everything was to go wrong? You need to know how their situation will affect you.

Sadly, I see many women in my financial planning firm that are trapped in relationships as they often have limited access to bank accounts, credit or savings and don’t know how they could afford to leave, pay rent or buy groceries to feed their family. Their challenges are very real and frightening.

In addition, I also work with couples early in their relationship is to seek financial guidance

Many beautiful partnerships encourage open dialogue around financial aspects, encouraging each other to be the very best version of themselves, including support to achieve financial goals. So, if this is something you desire, and wish to protect yourself from the negatives, then understanding each other’s expectations around money can be the key.

About Jodie Nolan

Economist, Financial Adviser & founder of RICHMum Program

Jodie Nolan has been called one of Australia’s most admired and respected financial advisers. With a Master’s Degree in Applied Finance, Jodie is a best-selling author, corporate presenter and the mastermind behind the new RICHMum Program – Inspiring women to real financial success!